Keynes argued that what is needed to reverse this

downslide

is an increase in government spending – a stimulus package of spending

increases, tax cuts, and deficits that would initiate a spending

multiplier

effect throughout the economy.

Government could even build bridges to nowhere, although

bridges to

somewhere would be better. Two

bridges would be better than one, and one would be better than no

bridge at

all.

When workers are paid for building the bridge(s), they will buy

goods

and services in the private sector of capitalism; and it would begin to

recover. Businesses will begin to prosper

and

hire

more workers, who will in turn spend more money, etc.

U.S. President-elect Barack Obama has announced that he will propose a stimulus package, perhaps in the vicinity of $500 - $750 billion. Many economists have argued that when private sector spending is falling dramatically, then more government spending is needed to fill the void – and the sooner, the better -- to avoid a second Great Depression. It could perhaps be on a scale of World War II military spending beginning in 1942, which brought the unemployment rate in the U.S. down from double digit to less than 2% in 1944. One of the reasons that the Great Depression lasted so long is that the government was timid about deficit spending. However, during WWII the U.S. federal government ran enormous deficits for the war, which not coincidentally pulled the economy out of the depression.

[Note: In 1929 total government purchases of public goods and services in the U.S. was $9.4 billion. The public debt was 16.3% of GDP. By 1939 government purchases had only increased to 14.8 billion annually, the debt was 52.2% of GDP primarily due to falling tax revenues (not tax cuts), and the unemployment rate lingered around 20%. In 1942 government purchases jumped to $62.7 billion and the unemployment rate fell to 4.7% in that same year. By 1946 the national debt was 122% of GDP and the economy was running on all cylinders].

The reason that the 2009 stimulus package has to be so large is that the problem is rapidly becoming more serious. The stimulus should be proportional the GDP gap, which is the difference between the actual GDP and the GDP at full employment. The further we go into recession, the larger the stimulus package needs to be. Unfortunately, we have not yet begun to see just how bad the U.S and the other economies can get. And the longer we wait to do something, the worse it will get before it gets better. It should come as no surprise to anyone when the unemployment rate in the U.S. reaches 8% or higher next year.

We cannot depend on monetary policy and financial bailouts to solve the immediate problem. The federal funds rate in the U.S. is already close to zero. Interest rates can’t get much lower, and lower interest rates are unlikely to stimulate the economy to any great degree. If the economy falls into a liquidity trap, then monetary policy simply won’t work. Troubled banks have a hard time lending to troubled borrowers. Monetary policy is notoriously impotent when it comes to stimulating an economy, and its upside lag times are very long. The deeper the recession, the weaker monetary policy becomes. Although low interest rates and bank liquidity and solvency may be necessary conditions for recovery, they are not sufficient.

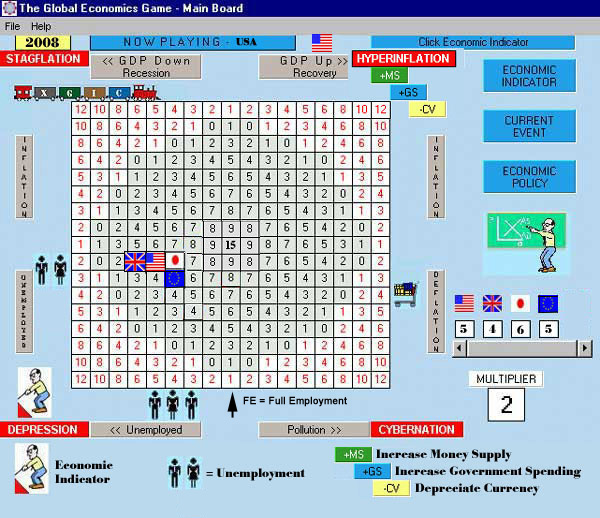

The Figure below shows the playing field of The Global Economics Game. It indicates that the United States, the United Kingdom, Japan, and the Euro area countries are already in a recession and heading toward a depression in the lower left hand corner of the playing field. The Economic Indicator points in the direction of the current trend in 2008.

The Figure also shows that the most direct counter-cyclical policy tools to get out of or to avoid a recession are: 1. Increase the Money Supply and, thereby, lower interest rates to indirectly stimulate consumer and business investment. 2. Increase Government Spending for public goods and services like infrastructure that will directly create new jobs. 3. Depreciate the Currency, which stimulates exports and curtails imports.

We’ve already noted that monetary policy may not be powerful enough to keep an economy out of or to get it out of a recession or depression. And the problem with depreciating a nation’s currency is that it exports the recession to the other country, which in turn, will want to depreciate its currency to avoid recession. Two countries can’t depreciate their currencies simultaneously. That leaves fiscal policy as the best and most effective policy – especially if all countries cooperate. If all of the countries were to initiate stimulus packages simultaneously, then they could change the economic indicator away from recession and toward full employment at the center of the playing field.

U.S. President-elect Barack Obama has announced that he will propose a stimulus package, perhaps in the vicinity of $500 - $750 billion. Many economists have argued that when private sector spending is falling dramatically, then more government spending is needed to fill the void – and the sooner, the better -- to avoid a second Great Depression. It could perhaps be on a scale of World War II military spending beginning in 1942, which brought the unemployment rate in the U.S. down from double digit to less than 2% in 1944. One of the reasons that the Great Depression lasted so long is that the government was timid about deficit spending. However, during WWII the U.S. federal government ran enormous deficits for the war, which not coincidentally pulled the economy out of the depression.

[Note: In 1929 total government purchases of public goods and services in the U.S. was $9.4 billion. The public debt was 16.3% of GDP. By 1939 government purchases had only increased to 14.8 billion annually, the debt was 52.2% of GDP primarily due to falling tax revenues (not tax cuts), and the unemployment rate lingered around 20%. In 1942 government purchases jumped to $62.7 billion and the unemployment rate fell to 4.7% in that same year. By 1946 the national debt was 122% of GDP and the economy was running on all cylinders].

The reason that the 2009 stimulus package has to be so large is that the problem is rapidly becoming more serious. The stimulus should be proportional the GDP gap, which is the difference between the actual GDP and the GDP at full employment. The further we go into recession, the larger the stimulus package needs to be. Unfortunately, we have not yet begun to see just how bad the U.S and the other economies can get. And the longer we wait to do something, the worse it will get before it gets better. It should come as no surprise to anyone when the unemployment rate in the U.S. reaches 8% or higher next year.

We cannot depend on monetary policy and financial bailouts to solve the immediate problem. The federal funds rate in the U.S. is already close to zero. Interest rates can’t get much lower, and lower interest rates are unlikely to stimulate the economy to any great degree. If the economy falls into a liquidity trap, then monetary policy simply won’t work. Troubled banks have a hard time lending to troubled borrowers. Monetary policy is notoriously impotent when it comes to stimulating an economy, and its upside lag times are very long. The deeper the recession, the weaker monetary policy becomes. Although low interest rates and bank liquidity and solvency may be necessary conditions for recovery, they are not sufficient.

The Figure below shows the playing field of The Global Economics Game. It indicates that the United States, the United Kingdom, Japan, and the Euro area countries are already in a recession and heading toward a depression in the lower left hand corner of the playing field. The Economic Indicator points in the direction of the current trend in 2008.

[Note: As an economy

moves from left to right on the playing field it grows faster. As it

moves up

it gets more inflation; as it moves down it gets disinflation and

deflation.

Black numbers in the playing field indicate a positive score. Red numbers indicate a negative score. The further into a corner an economy goes,

the worse its macroeconomic performance and the lower its score. The best score is in the very center where

there is full employment and other macroeconomic goals are in balance].

The Figure also shows that the most direct counter-cyclical policy tools to get out of or to avoid a recession are: 1. Increase the Money Supply and, thereby, lower interest rates to indirectly stimulate consumer and business investment. 2. Increase Government Spending for public goods and services like infrastructure that will directly create new jobs. 3. Depreciate the Currency, which stimulates exports and curtails imports.

We’ve already noted that monetary policy may not be powerful enough to keep an economy out of or to get it out of a recession or depression. And the problem with depreciating a nation’s currency is that it exports the recession to the other country, which in turn, will want to depreciate its currency to avoid recession. Two countries can’t depreciate their currencies simultaneously. That leaves fiscal policy as the best and most effective policy – especially if all countries cooperate. If all of the countries were to initiate stimulus packages simultaneously, then they could change the economic indicator away from recession and toward full employment at the center of the playing field.

What the Critics Will Say

There is probably no other topic in economics that is less understood and more misunderstood than the national debts of nations. People tend to draw comparisons between their own ability to manage debt and the government’s ability. The comparisons break down under close scrutiny. The common denominator is basic economic reasoning: If the marginal benefit of the debt is equal to or exceeds the marginal cost, then the debt is worthwhile. If, on the other hand, the benefits are less than the costs, then it’s not worthwhile.

Sending a son or daughter to college on borrowed money is worthwhile if they study and become successful. It is a mistake if they don’t study, flunk out and remain a low productivity worker or chronically unemployed. The same is true of governments. It makes sense to incur debt and spend money to defend freedom or to avoid a depression if the alternatives are to lose freedom or to live in abject poverty.

Another common ideological argument against deficit spending on the part of the government is that it crowds out the private sector. Pretty soon, the argument goes on, there is no private sector – only a public sector. Everyone will become dependant on the government for his or her economic well-being from health care to education to employment. While this argument may have merit in the long run, it doesn’t do anything for us in the short run. Right now, capitalism’s private sectors are shrinking. They are the problem, not the solution.

There is one caveat we should proffer regarding a contemporary deficit spending stimulus package for the United States. Historically, the U.S. government has deficit spent and run up the national debt when it was able to manage it with rapid economic growth in its future. After WWII, for example, the U.S. economy grew more rapidly than the debt and the debt/GDP ratio fell precipitously to 33% by 1980. This time it won’t be as easy for the U.S. economy to recover so rapidly. That’s because it faces much more competition from other countries around the world unlike the post WWII experience where it was competing with war torn nations. Increasing productivity in the U.S. relative to other countries is problematic. While that might make the rising debt more difficult to manage, it is not a strong enough argument to nullify the efficacy of the stimulus package that we need next year.

What about driving up the national debt?

Isn’t

that bad? The U.S. national is debt nearly

$10 trillion, which is about 70%

of its GDP. A major stimulus package

would increase the national debt/GDP ratio, because the debt would

initially

grow faster than the GDP. It is a

legitimate question to ask whether this would be good or bad.

There is probably no other topic in economics that is less understood and more misunderstood than the national debts of nations. People tend to draw comparisons between their own ability to manage debt and the government’s ability. The comparisons break down under close scrutiny. The common denominator is basic economic reasoning: If the marginal benefit of the debt is equal to or exceeds the marginal cost, then the debt is worthwhile. If, on the other hand, the benefits are less than the costs, then it’s not worthwhile.

Sending a son or daughter to college on borrowed money is worthwhile if they study and become successful. It is a mistake if they don’t study, flunk out and remain a low productivity worker or chronically unemployed. The same is true of governments. It makes sense to incur debt and spend money to defend freedom or to avoid a depression if the alternatives are to lose freedom or to live in abject poverty.

Another common ideological argument against deficit spending on the part of the government is that it crowds out the private sector. Pretty soon, the argument goes on, there is no private sector – only a public sector. Everyone will become dependant on the government for his or her economic well-being from health care to education to employment. While this argument may have merit in the long run, it doesn’t do anything for us in the short run. Right now, capitalism’s private sectors are shrinking. They are the problem, not the solution.

There is one caveat we should proffer regarding a contemporary deficit spending stimulus package for the United States. Historically, the U.S. government has deficit spent and run up the national debt when it was able to manage it with rapid economic growth in its future. After WWII, for example, the U.S. economy grew more rapidly than the debt and the debt/GDP ratio fell precipitously to 33% by 1980. This time it won’t be as easy for the U.S. economy to recover so rapidly. That’s because it faces much more competition from other countries around the world unlike the post WWII experience where it was competing with war torn nations. Increasing productivity in the U.S. relative to other countries is problematic. While that might make the rising debt more difficult to manage, it is not a strong enough argument to nullify the efficacy of the stimulus package that we need next year.

Return

to Home Page Return

to World Economics News

The Global Economics

Game (C)

2000-2004-2012

Ronald W. Schuelke All Rights Reserved