April

1999 Brazil devalued its currency (the real) on January 13,

1999.

It now takes more reais to purchase a unit of foreign currencies.

In effect, the people who have held portfolios of real assets have lost

purchasing power in the global market. From April 1998 to April

1999,

the real lost approximately one-third of its purchasing power.

One

Brazilian real will now buy about two-thirds of imported merchandise

that

it would have bought a year ago.

April

1999 Brazil devalued its currency (the real) on January 13,

1999.

It now takes more reais to purchase a unit of foreign currencies.

In effect, the people who have held portfolios of real assets have lost

purchasing power in the global market. From April 1998 to April

1999,

the real lost approximately one-third of its purchasing power.

One

Brazilian real will now buy about two-thirds of imported merchandise

that

it would have bought a year ago.

Countries are reluctant to devalue or depreciate their currencies in foreign exchange markets, because it results in a deterioration in their terms of trade. People in Brazil, for example, now have to work more hours to buy goods and services from other countries. They have to export more to buy imports. So, why do countries do this? Often, the answer is that they have no other choice. That was the case in Brazil.

In an attempt to maintain a fixed exchange rate, Brazil had been using up its foreign reserves of other currencies. The Brazilian central bank had been spending its reserves of US dollars, German marks, and British pounds to purchase excess supplies of reais. Foreign exchange speculators sensed that Brazil could not continue to do this indefinitely. They began to sell even more of their reais, draining still more of Brazil's reserves. When investors think that the assets they hold, which are denominated in a given currency, are about to go down in value, they naturally begin to exchange them for a different currency. This is called capital flight. Between April 1998 and January 1999, Brazil's reserves dwindled from $51.9 bn to $34.2 bn. That's when Brazil capitulated.

Prior to the devaluation, there had been an attempt in November 1998 to preempt the real devaluation with a $41.5 bn aid package put together by the International Monetary Fund (IMF) and the US Treasury. Besides protecting the purchasing power of Brazilians, the aid package was also motivated by the desire to protect foreign investments in Brazil. The package was contingent upon Brazil adopting an austere fiscal policy of government spending cuts and tax increases to reduce its relatively large budget deficit, which had reached 8% of the GDP in 1998.

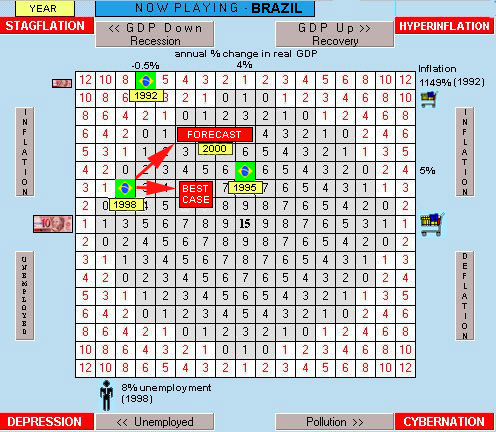

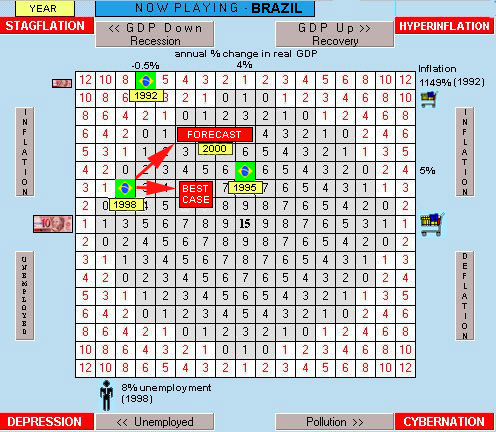

As it turned out, the aid package didn't work. It may not have worked under the best of circumstances. Attempting to maintain an over-valued fixed exchange rate is a de-facto appreciation of a currency. This is a drag on a country's economy, because exports fall (they are too expensive) and imports rise (they are cheap). Aggregate demand decreases. The Brazilian economy was in recession by the third quarter of 1998 when the GDP declined by 0.1%. In the fourth quarter the GDP went down by another 1.9%. The unemployment rate in Brazil rose to 8% in January 1999.

The Brazilian devaluation is expected to help turn this trend around. Exports should go up (they are now cheaper) and imports should go down (they are now more expensive). Aggregate demand will increase to expand the economy and help create more jobs. However, devaluation is almost always inflationary. Recent devaluations of the Russian ruble, the Indonesian rupiah, and the Mexican peso all resulted in dramatic increases in the general price level within the first year following the devaluations.

It remains to be seen just how high inflation will get in Brazil following its devaluation. The Brazilian government had been successful at containing inflation since 1995. Prior to that, Brazil had experienced hyperinflation, with rates exceeding 1000% annually in the early 1990s! Brazil's new real policy introduced in 1995 was designed to put an end to hyperinflation in Brazil.

The picture above shows that 1995 was one of Brazil's best years in the 1990s decade. Prior to 1995, Brazil was plagued by stagflation and hyperinflation. To demonstrate how inflation diminishes the purchasing power of money, the currency note and shopping cart both shrink as countries move up the playing area in The World Game of Economics . Because of the currency devaluation in January 1999, Brazil's economy is likely to eventually recover from the 1998 recession, but inflation is also likely to go up. The best case would be an economic recovery without accelerating inflation, but that is unlikely.

Brazil's overall economic performance is important in a global context. It is the largest economy in South America and the 8th-biggest economy in the world. In addition, currency devalutions are sometimes contagious, causing a series of currency bashings, capital flights, and devaluations in other countries.

The key to Brazil's economic outlook is getting control of its budget deficit. This is always difficult for a country, because it means cutting back expenditures and entitlements, while raising taxes at the same time. Restrictive fiscal and monetary policies can easily cause recessions. The hope for Brazil is that the contractionary effects of a tight fiscal policy will be offset by the expansionary effects of the currency devaluation without causing too much inflation. Above all, Brazil should not repeat the mistake of monetizing (i.e., printing money) its debt and fueling inflation as it has done in the past. That would merely send the economy back to stagflation and hyperinflation.

Brazil's Economic Performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|